Accounting & Finance Software

Home > Page

Introduction

In the dynamic world of small enterprise, effective economic management is vital. Accurate and efficient accounting practices but additionally provide valuable insights that pressure enterprise increase. Small enterprise owners often juggle more than one role, making it important to have strong equipment that simplify and streamline financial management. This is in which accounting software programs come into play. In this complete manual, we will explore the entirely small corporations need to know about accounting software, from its benefits to choosing the fine answer for you needs.

The Importance of Accounting Software for Small Businesses

Accounting software program is designed to automate and manipulate accounting obligations, which includes bookkeeping, invoicing, payroll, and economic reporting. For small organizations, those tools offer several key benefits:

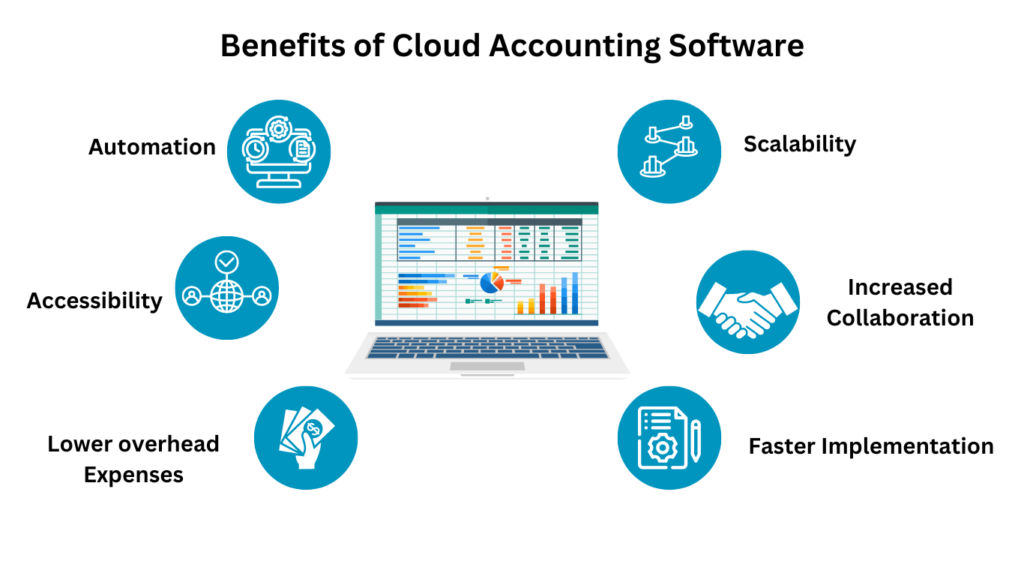

Time Efficiency: By automating routine tasks, accounting software frees up valuable time that enterprise proprietors and their group of workers can use to focus on different vital activities.

Accuracy: Automated calculations lessen the threat of human blunders, ensuring that financial records are accurate and reliable.

Compliance: Accounting software program helps ensure compliance with tax laws and guidelines via routinely generating reports and reminders for tax filings.

Financial Insights: Real-time monetary statistics and reporting talents provide insights which can be important for making knowledgeable enterprise decisions.

Scalability: As a business grows, its accounting wishes turn out to be more complex. Accounting software programs can scale to house increasing transaction volumes and extra functions.

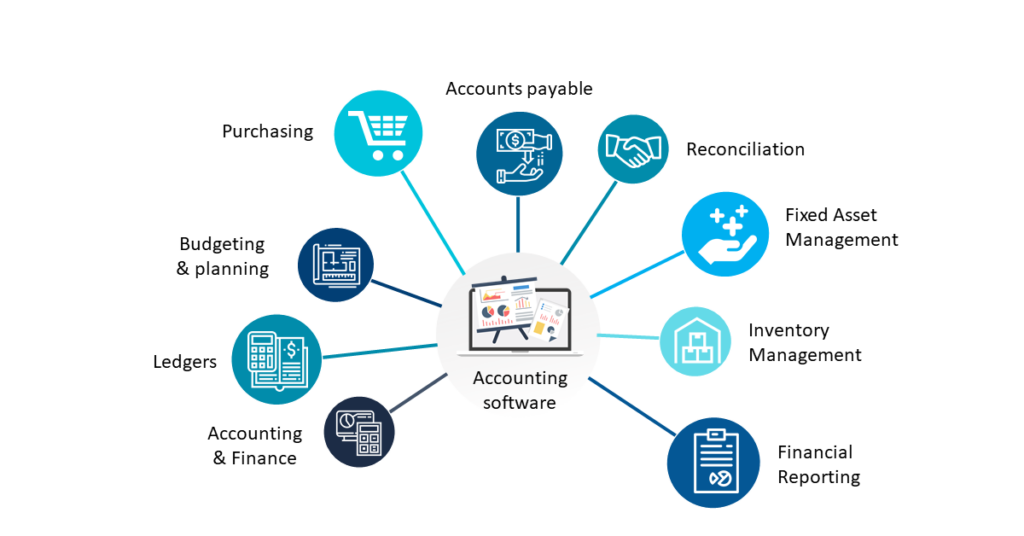

Key Features of Accounting Software

When evaluating accounting software for your small business, it is critical to not forget the capabilities of a good way to first-class help your operations. Here are some vital functions to look for:

Bookkeeping: Core bookkeeping features encompass tracking income and expenses, reconciling financial institution statements, and dealing with bills payable and receivable.

Invoicing: The ability to create and send professional invoices, track payments, and manage past due debts.

Expense Tracking: Tools to file and categorize commercial enterprise charges, upload receipts, and display coins flow.

Payroll Management: Automate payroll calculations, tax withholdings, and direct deposits.

Financial Reporting: Generate various economic reports inclusive of profit and loss statements, balance sheets, and coins go with the flow statements.

Tax Preparation: Tools to simplify tax guidance and submitting, together with automatic tax calculations and file generation.

Integration: Compatibility with different business equipment and structures, together with CRM software, payment processors, and e-trade structures. User-Friendly Interface: An intuitive and smooth-to-navigate interface that minimizes the learning curve for users.

How to Choose the Best Accounting Software

Selecting the first-rate accounting software in your small business calls for cautious attention of several elements:

- Assess Your Needs :

Start by comparing your business’s particular accounting wishes. Consider the extent of transactions, the complexity of your financial operations, and any unique necessities you could have, which include multi-forex assist or enterprise-specific capabilities. - Set a Budget:

Determine how great a deal you’re willing to spend on an accounting software program. While there are unfastened options available, making an investment in a paid solution can offer extra features and better assist. Consider both the in advance cost and any ongoing subscription fees. - Evaluate Ease of Use:

The software program must be person-pleasant and smooth to navigate. Look for answers that offer a clean interface and intuitive functions. Many accounting software providers offer unfastened trials, so take advantage of these to test the software program before committing. - Check for Integration Capabilities:

Ensure that the accounting software can combine with different gear and structures you use to your enterprise. This consists of CRM structures, e-trade platforms, charge processors, and banking services. Integration can substantially streamline your operations and reduce manual facts access. - Consider Scalability:

Choose a solution that may grow together with your business. As your business expands, your accounting wishes will become greater and more complicated. The software has to be capable of accommodating accelerated transaction volumes and provide advanced features as needed. - Read Reviews and Get Recommendations:

Research online opinions and are looking for guidelines from other small business proprietors to your industry. Real-international feedback can offer valuable insights into the software program’s strengths and weaknesses. - Evaluate Customer Support:

Good customer service is essential, particularly in case you come upon problems or have questions on the use of the software program. Look for vendors that provide comprehensive assist options, which includes phone, electronic mail, and stay chat.

Benefits of Accounting Software for Small Businesses

Streamlining Financial Management :

For small organizations, powerful economic control is vital for achievement.Best Accounting software simplifies and automates various financial duties, liberating up time and assets for extra strategic activities. From bookkeeping to invoicing, those tools streamline methods, ensuring accuracy and performance.

Enhanced Accuracy and Reduced Errors:

Manual accounting is liable to errors, which can result in sizable economic discrepancies. Accounting software automates calculations and information entry, drastically reducing the hazard of human error. This accuracy is critical for keeping reliable monetary facts and making informed business decisions.

Improved Financial Reporting:

One of the important advantages of accounting software programs for small agencies is its robust reporting capabilities. These gear generate certain economic reviews, including profit and loss statements, balance sheets, and coins flow statements. Access to real-time financial software information allows commercial enterprise proprietors to track overall performance, pick out trends, and make facts-pushed selections.

Cost Savings and Scalability:

Investing in accounting software can lead to sizable price savings. By automating ordinary obligations, businesses can reduce administrative overhead and avoid the prices associated with manual accounting mistakes. Additionally, many best accounting software answers are scalable, permitting groups to add functions and users as they develop.

Compliance and Security:

Accounting software enables certain compliance with tax rules and monetary reporting requirements. Automated tax calculations and reminders for tax filings lessen the threat of non-compliance. Furthermore, contemporary accounting software programs consist of sturdy safety capabilities to protect touchy monetary records, giving business owners peace of mind.

By leveraging the advantages of accounting software programs, small organizations can enhance their economic management, improve accuracy, and achieve more efficiency. For the ones looking to optimize their operations, making an investment in the right accounting software program is a strategic move towards long-time period achievement.

Also Read – ERP Software Development for Busniess.